Tech Trends and Insights from Silicon Valley: A Glimpse into the Future

Gain firsthand insights from Silicon Valley’s top visionary founders, investors, and industry leaders on the AI, robotics, and venture capital trends shaping the valley.

Our In Conversation With series shares personal and thought-provoking insights from inspiring individuals across diverse industries and backgrounds. It provides practical perspectives on how different forms of capital — intellectual, social, and financial — can be harnessed to drive innovation, growth, and meaningful change, while also offering investors valuable insights into the key trends shaping different sectors.

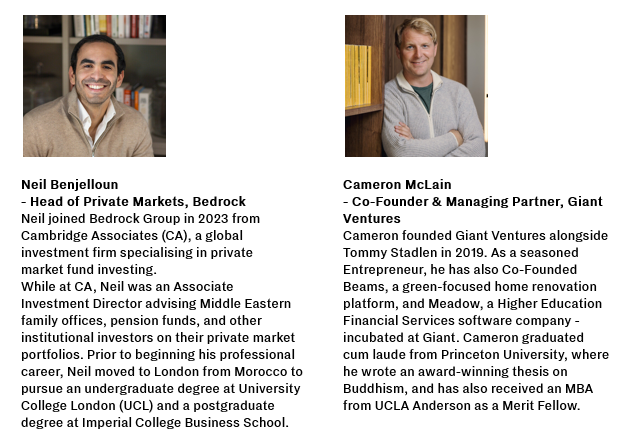

This time, Neil Benjelloun, Bedrock’s Head of Private Markets speaks to Cameron McLain, Co-Founder and Managing Partner of Giant Ventures – a multi-stage venture firm that backs purpose-driven technology founders solving the world’s most pressing challenges across three major themes – climate, health, and inclusive capitalism – across the UK, the US, and the Nordics – to delve deeper into the rise of VC funding for climate-related initiatives and to shed some light on this area of the market.

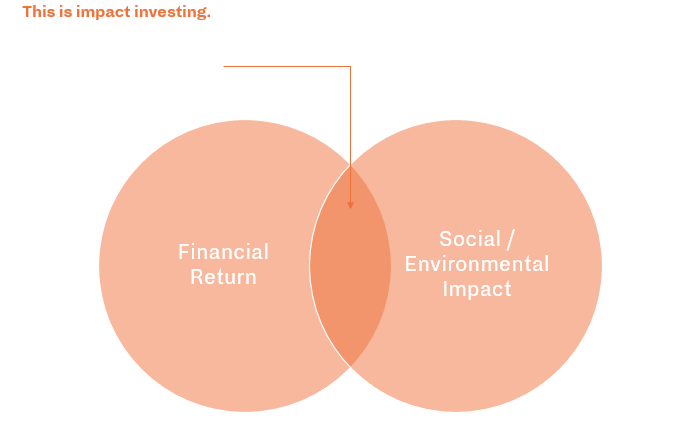

As concerns about environmental degradation, scarcity and inequality grow around the world, the investment community is increasingly turning its attention to seeking positive environmental and social change, alongside financial returns – “doing well by doing good”. A way to meet this goal is by allocating capital to businesses that are expected to generate social and environmental benefits as well as profits.

A 2023 report by European Venture Capital (VC) firm A/O shows a significant rise in VC funding for climate-related initiatives. Climate themes now constitute 70% of built world technology VC dollars. In the UK, climate tech made up 29% of all VC investment in 2023, reaching a record $6.2 billion [1]. Additionally, PwC’s 2023 State of Climate Tech report indicates that climate tech’s share of VC and Private Equity (PE) funding surpassed 10% of private market startup investments in 2023, an increase from 7% in 2018. [2]

Q: [Neil] Can you tell us a bit about yourself and provide an overview of Giant VC, the firm’s history, founding principle, and thesis?

A: [Cameron] Sure, I’m Co-Founder and Managing Partner of Giant Ventures. Prior to Giant, I’ve been involved in technology entrepreneurship and investing for around 15 years. I co-founded and sold a big data social analytics company in California called Beehive in 2015, and have also had extensive experience as an angel investor. I initially went to the US to study philosophy and music at Princeton – and one fun fact that entrepreneurs tend to love is that I wrote some music albums and had my music selected for TV. My journey eventually led me back to Europe, and I worked at a venture fund called Hummingbird, where I helped open up their London office. I founded Giant Ventures with my long-time friend Tommy Stadlen almost five years ago, founded on the premise that the most impactful companies of the next 20 years will solve significant environmental and social challenges. Giant Ventures was born from this belief, aiming to be the optimal partner for entrepreneurs building such companies. We saw an increasing number of high-quality entrepreneurs wanting to pursue mission-driven businesses, coupled with regulatory and technological advancements conducive to such ventures. Our promise to our investors has always been to deliver both top venture returns and impact, with the conviction that our focus on impact enhances our potential for strong financial returns.

“We saw an increasing number of high-quality entrepreneurs wanting to pursue mission-driven businesses, coupled with regulatory and technological advancements conducive to such ventures.”

Q: [Neil] What role do you see PE & VC playing in solving the issues that impact-focused businesses are tackling?

A: [Cameron] VCs are crucial for supporting innovation, whether in business models or technology. This is where their role shines, providing risk capital for ambitious technology ventures, which acts as a multiplier for impactful solutions. Historically, technology has been the driving force behind scaling impact, and this trend is likely to continue. PE firms, on the other hand, can play a significant role in helping companies scale their impact through strategies like bolt-on acquisitions or roll-ups, leveraging their majority control. Unlike VCs, PE firms typically hold majority shares, giving them an advantage in governance and scaling businesses. However, a cultural lack of concern for impact within some PE firms has historically hindered progress.

“VCs are crucial for supporting innovation. This is where their role shines, providing risk capital for ambitious ventures, especially in technology, which acts as a multiplier for impactful solutions.”

Q: [Neil] How have you seen the impact investing landscape develop since launching Giant?

A: [Cameron] When we started nearly five years ago, there was some scepticism surrounding impact investing with many associating it with, what I would call, impact 1.0 firms and the misconception that it meant sacrificing returns. However, significant shifts have occurred since then. Two key events stand out: the rise of Tesla, a now 600 billion-dollar company leading the charge in the green transition, and the COVID-19 pandemic, which highlighted the fragility of our world and spurred a movement towards environmental consciousness. In terms of investment trends, there’s been a noticeable increase in funding towards climate-related initiatives, particularly at the seed stage with the emergence of several new seed funds and angel investors dedicated to climate investing. Additionally, established franchises like TPG Rise and KKR have raised substantial funds. Overall, there’s a growing recognition that profitability and purpose can indeed coexist, driving a more positive outlook on impact investing.

“Overall, there’s a growing recognition that profitability and purpose can indeed coexist, driving a more positive outlook on impact investing.”

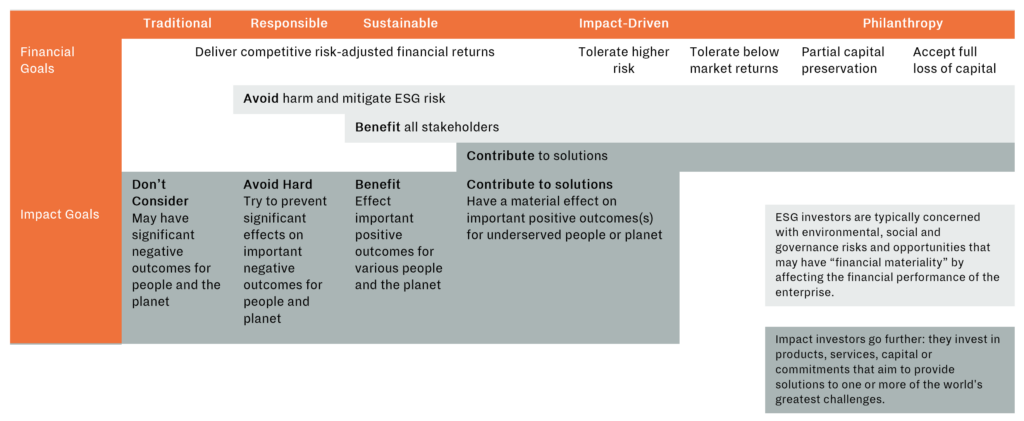

Q: [Neil] You touched on impact investing being concessionary in some respects. Could you speak to this inherent trade-off between returns and impact in the context of your engagement with purpose-driven founders?

A: [Cameron] Good question. Impact is a spectrum, and at Giant, we focus on companies where we can deliver top-tier venture returns alongside impact. While some may claim that all ventures can achieve both, the reality is different; certain impactful ventures may achieve impact but yield concessionary returns. For instance, the Gates Foundation prioritises impact over market returns in its investments in breakthrough energy. At Giant, we seek founders who are deeply mission-driven yet also commercially driven —a rare combination. In the past founders leaned towards impact without commercial scale, but now we see a shift towards pragmatic individuals with experience in demanding environments like Fintech, who have been forged in the fires of hard charging management. These founders understand the challenges of scaling a company while remaining deeply committed to the mission.

Before investing, we believe that impact VCs should assess both mission alignment as well as commercial pragmatism. For example, Giant’s term sheets require companies to prioritise impact in their mission, with clauses allowing us to exit if this commitment waivers. This approach resonates with entrepreneurs, as they recognise our genuine commitment to impact combined with pragmatism. We understand that impact is only achievable at scale, so we gradually increase impact rigour as companies achieve product-market fit and scale.

Q: [Neil] Could you touch on the importance of impact investing frameworks, such as IRIS+ and the UN’s Sustainable Development Goals (SDGs), in the categorising, monitoring, and reporting of impact?

A: [Cameron] I believe frameworks like IRIS are incredibly valuable for bringing objectivity and standardisation to impact assessment, which can often feel open-ended. While we utilise IRIS metrics and the Impact Management Project framework for thorough impact analysis, we also prioritise pragmatism. While the UN SDGs offer helpful guidance, there are 17 SDGs with 169 sub-targets, which can be overwhelming. We advocate for clearer focus, recommending a select number of key targets rather than trying to address them all. As companies scale, increasing objectivity in impact assessment is essential, with initiatives like Generation Impact’s goals leading the way in this regard.

Q: [Neil] You mentioned Tesla and other disruptors in the climate sector who gained significant market share. Do you believe the future lies with more disruptive players or in persuading major oil CEOs, for example, to make strategic investments?

A: [Cameron] It’s a mix of both. The element of surprise, like Elon had with Tesla, is somewhat gone now, as most recognise the impending transition and the need for investment. Oil and gas majors may make substantial acquisitions of startups, but they’re also hindered by the challenge of innovating without cannibalising their core business. We’ll likely see continued emergence of substitute businesses in climate tech, such as electric vehicles or solar energy solutions – particularly as regulatory initiatives such as the $1+ trillion infrastructure bill passed in the US provide much-needed subsidies. Companies like Greg Jackson’s Octopus Energy are just the beginning of what’s possible in clean energy. Transitioning from centralised to decentralised energy creation will bring disruption, with both incumbents and new players vying for market share. Ultimately, we expect a new generation of companies to offer alternatives to legacy hydrocarbon-emitting options.

“Ultimately, we expect a new generation of companies to offer alternatives to legacy hydrocarbon-emitting options.”

Q: [Neil] How do you see the market and exit routes maturing?

A: [Cameron] I think it’s going to be a blend. I anticipate a combination of strategies including increased involvement from private equity (PE) firms, especially those specialising in green infrastructure. In Europe, where capital markets pose challenges, we may witness more acquisitions by incumbents. Despite challenges, the climate sector has remained resilient, with $70 billion deployed in 2022 and $50 billion in 2023, making it the second-largest sector for investment after AI. This trend underscores the urgency of addressing climate change. The current market climate has seen slow but steady growth, with expectations of normalisation by 2025. Although the seed market has been somewhat distorted by large multi-stage funds, innovative non-equity financing options are emerging, accelerating progress in the climate sector. Overall, investing in climate solutions aligns with both financial and environmental interests, offering a bright spot amidst broader market dynamics.

Q: [Neil] Although a dollar invested in emerging markets typically stretches further than in developed markets, particularly from an impact perspective, investors tend to opt for the latter. Could you speak to this trade-off and investor preference for developed market impact investing?

A: [Cameron] Investors tend to favour developed markets over emerging ones due to the heightened risks, particularly geopolitical ones, associated with the latter. However, as more impact-first business models prove successful in developed markets, they may be replicated in emerging ones, mitigating business model risk. Nevertheless, investing in emerging markets is still considered more risky due to geopolitical uncertainties

“As more impact-first business models prove successful in developed markets, they may be replicated in emerging ones, mitigating business model risk.”

In terms of liquidity routes, the US and Europe also offer clearer paths, with the US benefiting from substantial climate tech subsidies and Europe showcasing stronger corporate commitment to the transition. While Europe’s regulatory landscape is more defined, it can vary across different regions, posing scalability challenges. Despite this, opportunities abound, especially in the healthcare sector, where digital health solutions are gaining traction. As an example, we invested in a business called Doccla here in the UK, which is now Europe’s leading virtual ward helping hospitals provide remote patient monitoring for patients at home both to drive down costs and improve patient care. Also notably, we recognise that the advent of AI has created some very exciting opportunities in gene mapping, for example. This is an area where the UK has a lot of strength given research institutions and AI talent is meaningful here.

Impact investing reflects a broader transition towards values-driven decision-making in finance. By integrating financial goals with social and environmental objectives, investors can foster innovation, attract top talent, and drive industry-wide change.

From the discussion with Cameron, 4 key takeaways came out when it comes to VC-funded impact focused investing:

If you have any questions about the themes discussed in this article, please do not hesitate to get in contact with us at info@bedrockgroup.ch

Sources

[1] https://www.stateofbuiltworldtech.com/

[2] https://www.pwc.com/gx/en/news-room/press-releases/2023/pwc-2023-state-of-climate-tech.html

Important Legal Information

This document has been approved and issued by Bedrock SA licensed under Swiss Law, authorised by the Swiss Financial Market Supervisory Authority (FINMA) and supervised by the AOOS; Bedrock Monaco SAM authorised and regulated by the Commission for the Control of Financial Activities (“CCAF”); and Bedrock Asset Management (UK) Ltd. authorised and regulated by the Financial Conduct Authority in the UK (jointly, hereafter, “Bedrock”).

The information and opinions contained in this document are provided for background information and discussion purposes only and do not purport to be full or complete. No information in this document should be construed as providing financial, investment or other professional advice. This information contained herein is for the sole use of its intended recipient and may not be copied or otherwise distributed or published without Bedrock’s express consent. No reliance may be placed for any purpose on the information contained in this document or their accuracy or completeness. Information included in this document is intended for those investors who meet the Financial Conduct Authority definition of Professional Client or Eligible Counterparty or for those investors who meet the Swiss Federal Act on Financial Services Act (FinSA) of a Professional Client.

Investment risks

The value of all investments and the income derived from them can fluctuate due to market movements and you may not get back the amount originally invested. In the case of overseas investments, values may vary as a result of changes in currency exchange rates. This may be due, in part, to exchange rate fluctuations in investments that have an exposure to currencies other than the base currency of the portfolio. Investments in commercial buildings may prove illiquid in terms of the time taken to sell such assets. Past performance is no guide to or guarantee of future performance.

Alternative investments risks in general

As a professional client, you should be aware that investing in alternative investments can carry significant risks. Alternative investments are investments that do not fall under the traditional categories of stocks, bonds, and cash.

Examples of alternative investments include hedge funds, private equity, venture capital, and real estate.

Under the FCA financial promotions framework, alternative investments can only be promoted to professional clients, such as yourself. This is because professional clients are deemed to have the necessary knowledge and experience to understand the risks involved in these investments.

However, even with this level of expertise, it is important to be aware of the risks involved in alternative investments. Some of the risks include:

•Illiquidity: Alternative investments can be difficult to sell quickly, which means that you may not be able to access your money when you need it.

•Lack of transparency: Alternative investments are often less transparent than traditional investments, which means that it can be difficult to get a clear picture of the underlying assets and their performance.

•Complexity: Alternative investments can be complex, with unique features and structures that may be difficult to understand.

•Concentration risk: Alternative investments often require a large minimum investment, which means that you may end up with a concentrated portfolio and a high degree of exposure to a single investment.

•Higher fees: Alternative investments often come with higher fees than traditional investments, which can eat into your returns.

It is important to carefully consider these risks before investing in alternative investments. You should also ensure that you understand the terms of the investment, including any fees and charges, before committing your money.

If you have any questions or concerns about investing in alternative investments, you should seek the advice of a professional financial advisor who is qualified to advise on these types of investments.

Risks related to Private Equity (PE)

•Capital at risk: investment in PE carries a risk to the capital invested and that you may lose some or all of their capital invested.

•Illiquidity: investment in PE can be difficult to sell quickly, which means that you may not be able to access your money when you need it.

•Limited liquidity events: the investment in a PE may only provide limited liquidity events, such as partial or full company sales or mergers, and such events may not occur for several years.

•Unlisted security: the investment in a PE is an unlisted security and there is no established market for trading the shares.

Investment suitability: the investment in a PE may not be suitable for all you, and potential you should seek professional advice before investing.

•Concentration of investment: the investment in a PE will typically involve a concentration of assets and you should consider the risks associated with this.

•Complex structure: the investment in a PE may have a complex legal and tax structure, and you should seek professional advice to understand the risks associated with this.

•Fees and expenses: all fees and expenses associated with the investment in a PE, including management fees, performance fees, and other charges, and explain how these fees will be calculated and deducted.

•Regulatory risk: the investment in a PE may be subject to regulatory risk, and that changes in regulations could negatively impact the investment.

If you are considering investing in private you should carefully evaluate these risks, conduct thorough due diligence, and be prepared for longer investment horizons and potential illiquidity. Consulting with a qualified financial advisor or private market expert is essential to make informed investment decisions.