March Market Update 2025

This month we discuss the market volatility in March, the new US tariffs—both implemented and announced, developments in the Russo-Ukrainian war, the latest economic data, and the outlook for the almighty US dollar.

After a blistering rally since Donald Trump’s re-election, Bedrock’s Research Team ask if there is more room to run for European defence equities, amid dramatic geostrategic shifts on the continent.

European defence stocks have soared since Donald Trump’s return to the White House.

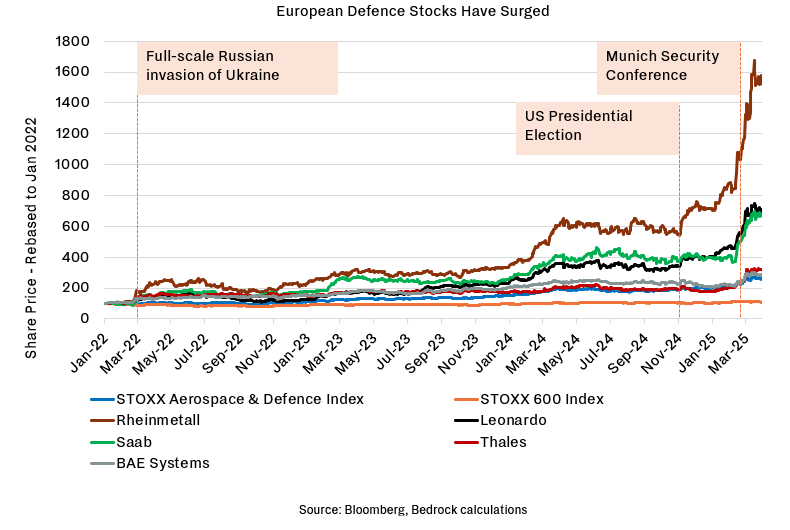

Caught between Donald Trump’s unpredictable America and Vladimir Putin’s aggressive Russia, Europe is moving with new urgency to invest in its own security—and rearm. As a result, shares in the continent’s weapons producers have taken off. While the likes of Rheinmetall, Germany’s leading defence contractor, began their current stock market ascent with Russia’s 2022 invasion of Ukraine, a string of more recent events has seen them explode upwards as the geopolitical ground has shifted dramatically.

The STOXX Europe Aerospace and Defence Index has risen +34.9% since November’s US election. Having already quadrupled between the day Russian tanks crossed Ukraine’s border in 2022 and the day Americans went to the polls in 2024, Rheinmetall has gained another +173% since the presidential vote (for a scorching +1258% rise across the full three-year span). France’s Thales and Italy’s Leonardo are up +64% and 101%, respectively, since November.

“A string of recent events has seen them explode upwards as the geopolitical ground has shifted dramatically.”

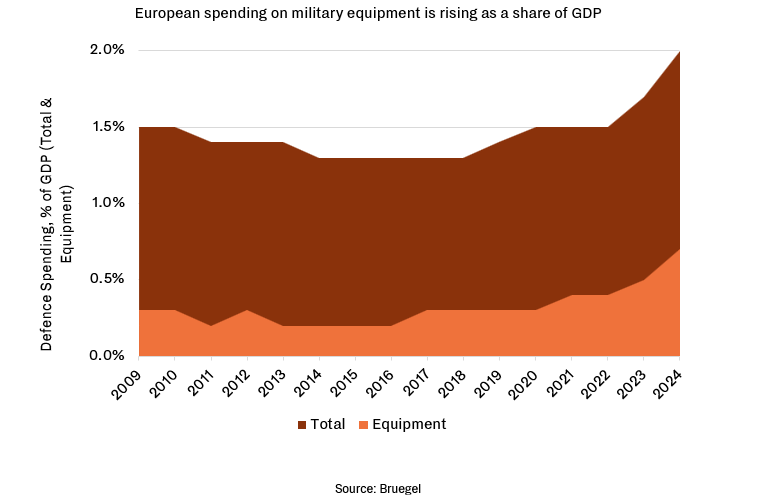

European defence spending growth is accelerating sharply, feeding through to suppliers’ order books and earnings.

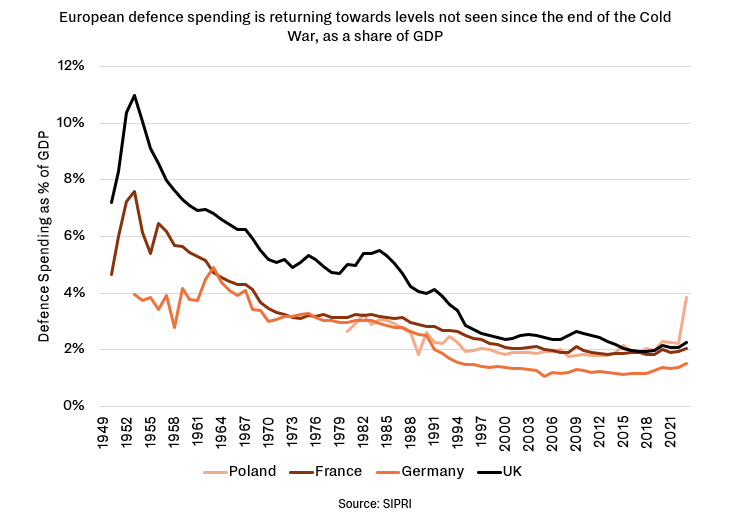

In the first instance, this share price action reflects European defence contractors’ already expanded earning power. The radically changed geostrategic environment since Russia’s full-scale invasion of Ukraine has seen European defence budgets rise. Trump’s stance since returning to power—raising stark questions about the long-standing US commitment to defend Europe—has added fuel to the fiscal fire. European defence spending has been on a decade-long upward trend, adding an annualised +3.9% in real terms between 2014 and 2024. But the rate of growth is accelerating. Defence expenditures surged +12% YoY in 2024 to hit $457bn across Europe, according to International Institute for Strategic Studies data.

This has taken spending to levels not seen since the end of the Cold War. And it has had a direct impact on suppliers’ order books. Rheinmetall reported +50% sales growth in its defence business in 2024, with its order backlog +44% to a record €55bn. Leonardo saw +27% Free Cash Flow growth and orders up +12%, while Dassault Aviation’s defence sales growth reached +33% YoY.

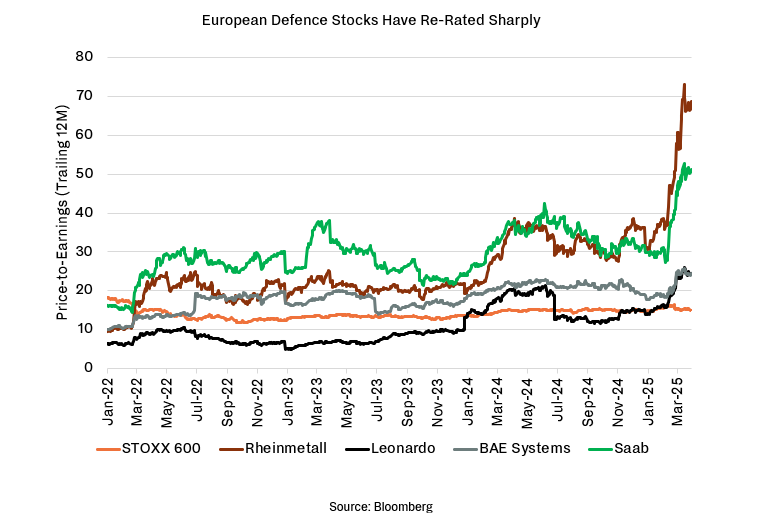

Many European defence equities were cheaply priced Value stocks but have now rerated—aided by changing perceptions of the sector’s ethical implications.

The ongoing share-price surge marks a rapid investor reappraisal of a sector that had previously enjoyed little favour.

One important shift is in ‘values’—and ethical restrictions. Where the defence sector was de facto taboo or explicitly out-of-bounds for many large investors, especially European institutional investors, that ground is rapidly moving. In the changed geopolitical environment, European defence companies are increasingly understood as purveyors of the wherewithal to protect European security—and values. This process is ongoing; for some major investors, explicit rules would need changing. This is the case, for example, for Norway’s $1.7tn sovereign wealth fund—the world’s largest—whose parliamentary-defined rules bar it from holding defence stocks but where there is new political pressure to change that legislation. For other rules-bound investors (notably many major pension fund managers), it has been more a question of reassessing defence stocks’ compliance with existing ESG rules, without needing to change them.

The other shift is in ‘value’: broader investors’ (re)valuation of the stocks and their growth potential, as visible in substantial multiple expansion. This has taken European defence contractors out of the underpriced Value bracket where many (such as Rheinmetall) had long languished. Rheinmetall’s price-to-earnings ratio (trailing 12 months) has rocketed from 9.6x at the start of 2022 to 68.9x now – propelling the stock into Germany’s blue-chip DAX-40 index. Other peers have seen strong, if less extreme, re-ratings and the same ratio for the STOXX Europe Aerospace and Defence Index as a whole now stands at 40.2x. As such, investors are showing themselves willing to pay more for a far rosier growth outlook.

“The ongoing share-price surge marks a rapid investor reappraisal of a sector that had previously enjoyed little favour.”

Ukraine developments have driven much of the price gains and expected demand growth. Share prices point to c.2.5% of GDP spent on defence in the coming years.

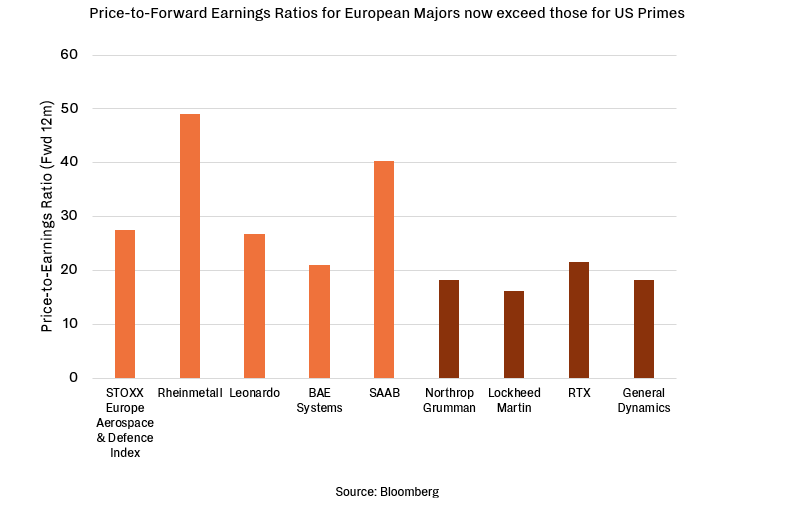

The question, after such powerful share-price gains, is how much growth is now already priced in. With European defence majors’ forward price-to-earnings ratios now pushing beyond those of the US primes (who dwarf their European counterparts in terms of market capitalisation and earnings), can they now grow earnings further than their share prices currently fully reward?

In short, that looks plausible – if, of course, uncertain.

Much of what has driven share prices to date are Ukraine-related developments. Since February 2022, Europe (including the UK) has given Ukraine €62bn of military support (only a short way behind the US’ €64bn, despite what Trump and his acolytes imagine). This has created an urgent need for European militaries to restock systems and ammunition sent to Kyiv. But Europe’s Ukraine-related demand growth has now been dramatically accelerated by Trump’s stance (namely deep scepticism about further US military aid, while pushing Kyiv to sue for peace). This has left European governments looking to plug the gap, and encouraged investors to bid up the stocks of those companies poised to help them do so. But to put this demand driver in context, for Europe to replace the US’ €20bn of military aid to Ukraine in 2024 (in simple financial terms, at least) would represent just 0.12% of Europe’s GDP.

What European policymakers are now gearing up for is orders of magnitude larger—and share prices appear to have only caught up with part of this. With the recent gains, European defence stock prices are approximately commensurate with defence budgets across the continent reaching c.2.5% of GDP on average. This would, to be sure, be a step up from the current level of an average of 2.2% for European NATO members in 2024, or an aggregate 1.9% of EU total GDP for EU member states (the European memberships of the EU and NATO overlap substantially but, importantly, are not coterminous).

“What European policymakers are now gearing up for is orders of magnitude larger—and share prices appear to have only caught up with part of this.”

Historical precedent, a radically changed threat environment, urgent political rhetoric, and new spending plans all suggest European defence spending could rise beyond an average of 2.5% of GDP.

But will European defence spending just rise to 2.5% of GDP and stop there? Looking at the threat environment, policymakers’ rhetoric and European governments’ latest spending plans—the latter of which are coming in thick and fast—suggest 2.5% may be conservative. Amongst the continent’s largest military spenders in absolute terms, Poland’s defence spending will hit 4.7% of GDP in 2025 (while smaller players Latvia and Lithuania plan to exceed 5%). The UK, one of Europe’s two nuclear powers, has announced spending will rise to 2.5% of GDP in 2027 and target 3% from 2030. NATO’s newest member, Sweden, has announced a 3.5% target by 2030.

But the key variable for additional defence spend in the next five years is Germany, Europe’s largest economy and industrial power. Germany is also Europe’s largest defence spender in absolute terms; with an $86bn defence budget in 2024, it ranked second behind only the US. Its defence spending has nonetheless long lagged relative to its total productive capacity (though it finally reached NATO’s 2%-of-GDP target in 2024), which has had a significant knock-on effect on its military capabilities and readiness.

This looks set to change under the presumed incoming CDU-SPD government led by Friedrich Merz. Hitherto fiscally conservative and profoundly Atlanticist, Merz has performed an abrupt turn in the face of transatlantic developments. He has called for Europe to build independence from the US as an ‘absolute priority’ and backed this with action, urgently forcing through a long-overdue change to Germany’s debt brake and restrictive fiscal stance. The reform package includes an exemption from the debt brake of defence spending over 1% of GDP. This would translate to a defence spend of 3-3.5% of GDP – in euro terms, between €720bn and €985bn in additional defence spending.

Historical precedent adds to the view that 2.5% of GDP is conservative. In the latter decades of the Cold War, European countries spent 3-6% of GDP on defence. The geostrategic context differs sharply but the fact that multiple European governments believe Russia would be ready to attack an EU member state (most likely one of the Baltics) in 3-10 years implies risk perceptions keep the Cold War precedent relevant.

European militaries’ shopping lists will be long – and a greater share of additional spending will go to equipment, magnifying the impact on defence suppliers’ revenues.

A crucial point for defence stocks is that the bulk of the additional spending will go to equipment (as opposed to other budget items, such as salaries, recruitment and pensions). At present, less than half of EU countries’ total defence spending goes to equipment. But this is on an upward trend (rising to 0.7% of GDP in 2024) and equipment is the focus of identified spending needs. Not only do European militaries need to restock after Ukraine donations; they need to recapitalise their militaries after decades of underinvestment, and expand and modernise their capabilities. To act without the US, Europe would need to develop whole new capabilities—such as strategic lift and intelligence platforms.

A recent Bundestag report found that the German military had ‘too little of everything’. While not all European militaries are as threadbare as the Bundeswehr, lessons from Ukraine suggest ‘more of everything’ will read across. The return of sustained land combat points to the need for tanks, artillery and vast ammunition stockpiles. The renewed threat from an opponent able to contest air dominance (as opposed to the counter-insurgency conflicts of Iraq and Afghanistan) adds aerial defence capabilities to shopping lists (including missile defence, sensors, and aircraft). But the Ukraine war has also pointed the way to technological innovation: Europe will have to invest more in drones and cyber warfare.

This suggests that a broad spread of Europe’s defence-industrial base, as well as many companies with dual-use civil/military product lines, stand to benefit from increased spending. The increased share of equipment spending means that an increase from e.g. 2% to 3% of GDP on defence translates to a greater than +50% increase in weapons purchases. Instead, a multiple of a 2.5x-3.5x increase in equipment budgets is more likely.

“A broad spread of Europe’s defence-industrial base, as well as many companies with dual-use civil/military product lines, stand to benefit from increased spending.”

Despite the recent rally, European defence stocks remain under-owned and a small part of European capital markets. With earnings upgrades likely to continue, there is runway for more growth as the sector becomes a structural winner.

For all the striking urgency of policymakers’ pronouncements about the seriousness of Europe’s new geopolitical context, there is no guarantee that European defence spending will rise beyond—or even to—2.5% of GDP. But there are sufficient grounds for confidence that additional hundreds of billions of euros will be spent on defence in the next decade—and that the bulk of this will reach the continent’s defence contractors. Even after the recent rally, investment bank positioning data shows the sector remains under-owned by real money investors. Defence still accounts for just 1.8% of the MSCI Europe Index. This year’s rally has been dominated by multiple expansion—before consensus earnings upgrades. The policy environment remains in fast-moving flux, with new spending targets coming and budgetary decisions yet to be made. As these decisions come through and procurement orders are placed, this will bring greater clarity to defence company revenues and pave the way for earnings upgrades over the next two years. This could point to the sector’s emergence as a structural winner of a dramatically changed European security paradigm.

“This could point to the sector’s emergence as a structural winner of a dramatically changed European security paradigm.”

If you have any questions about the themes discussed in this article, please do not hesitate to get in contact with us: info@bedrockgroup.ch.

Important Legal Information

The content of this document has been prepared by Bedrock S.A., Bedrock Monaco SAM, and Bedrock Asset Management (UK) Ltd. (jointly, hereafter, “Bedrock”).

The information and opinions contained in this document are for background information and discussion purposes only and do not purport to be full or complete. No information in this document should be construed as providing financial, investment or other professional advice.

The information contained herein is intended for the sole use of the recipient and may not be copied or otherwise distributed or published without the express consent of Bedrock. Although the information contained herein has been established by Bedrock based on or by reference to sources, documents and systems it believes to be reliable and accurate, Bedrock does not guarantee its accuracy or completeness and assumes no responsibility for any losses that may arise from the use of this information. The views and opinions expressed herein are based on current market conditions and are subject to change without notice. No representation is made that any forecast or projection will be realised.

Information included in this document is intended for those investors who meet the definition of Professional Client under the Swiss FinSA regulation as well as Professional Client or Eligible Counterparty under the UK Financial Conduct Authority.

Confidentiality

This presentation and the information contained herein are confidential. Each copy of this presentation is addressed to a specifically named recipient and shall not be passed on to a third party. By its acceptance hereof, the recipient agrees to keep the presentation and its contents strictly confidential and may not disclose or divulge any information contained herein to any other person. This presentation cannot be published, copied, reproduced or distributed in any manner whatsoever. The recipient will use this presentation for the sole purpose of obtaining a general understanding of the business, operations and financial performance of Bedrock in order to make a decision as to whether the recipient should proceed with a further investigation of the Funds and this investment opportunity. Bedrock reserves the right to request the return of this presentation at any time, without the retention of any copies by the prospective investor.

Investment Risks

The value of all investments and the income derived therefrom can fluctuate due to market movements and you may not get back the amount originally invested. In the case of overseas investments, values may vary as a result of changes in currency exchange rates. This may be due, in part, to exchange rate fluctuations in investments that have an exposure to currencies other than the base currency of the portfolio. Past performance is no guide to or guarantee of future performance. Investments in fixed income carry risks including credit risk, interest rate risk, and liquidity risk. The value of investments can go down as well as up, and you may not get back the full amount invested.

Limitation of Liability and Indemnity

Bedrock expressly disclaims liability for errors or omissions in the information and data contained in this document. No representation or warranty of any kind, implied, expressed or statutory, is given in conjunction with the information and data. Bedrock accepts no liability for any loss or damage arising out of the use or misuse of or reliance on the information provided including, without limitation, any loss of profits or any other damage, direct or consequential. You agree to indemnify and hold harm less Bedrock and its affiliates, and the directors and employees of Bedrock and its affiliates from and against any and all liabilities, claims, damages, losses or expenses, including legal fees and expenses arising out of your access to or use of the information in this presentation, save to the extent that such losses may not be excluded pursuant to applicable law or regulation. Any opinions contained in this presentation may be changed after issue at any time without notice.

Copyright and Other Rights

The copyright, trademarks and all similar rights of this presentation and the contents, including all information, graphics, code, text and design, are owned by Bedrock.